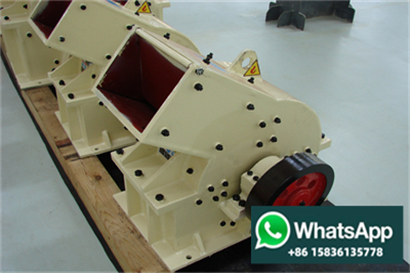

تلتزم الشركة دائمًا بمعدات سحق التعدين ومعدات صنع الرمل ومعدات الطحن الصناعية، وتوفير حلول عالية الجودة للرمل والحصى ومجموعات كاملة من المعدات للمشاريع الهندسية واسعة النطاق مثل الطرق السريعة والسكك الحديدية والمياه والكهرباء، إلخ. ، وتسعى جاهدة لممارسة التصنيع الدقيق المحلي والتخطيط العلمي العالمي، مع اعتبار آسيا المنطقة النائية والعملاء المشعين حول العالم. بعد أكثر من 30 عامًا من التطوير، نجحت العديد من منتجات الشركة في اجتياز العديد من شهادات الجودة الدولية مثل الشهادة الدولية ISO9001:2015، وشهادة الاتحاد الأوروبي CE، وشهادة GOST الروسية. بعد ذلك، في السعي لتحقيق التميز، سنستمر في استخدام منتجات عالية الجودة والتكنولوجيا الاحترافية والخدمات المخلصة لمساعدة العملاء على خلق قيمة أكبر، واستخدام الإجراءات العملية لمواصلة تعزيز البناء البيئي للحضارة الإنسانية.

1 ·Production related rent is earned on each tonne of coal extracted from existing operating coal mining sites Incidental coal is royalty income from other sites where coal production is incidental to the main purpose of the activity being carried out Royalty rates vary between licences and are commercially confidential Companies also pay

·Mineral royalty administrative arrangements Under the Mineral Royalty Act 1982 royalty is liable at the greater of 20% of net value profit minus $10 000 or a minimum royalty which is 1% 2% or % of the gross production revenue sales value of minerals The formula to determine the net value is The net value can be either negative if a mine makes a

·Several African countries have started to update their mining codes by increasing their royalty rates In 2010 Burkina Faso indexed its royalty rates such that the effective rate varies positively with commodity gold prices Specifically the minimum royalty rate is 3% which increases to 4% for gold prices between USD1 000 per ounce and USD1 300 per

It applies to businesses when they make payments to other business entities or individuals in the form of dividends interest and royalties The benchmark we use refers to the standard withholding tax rate on interest for non residents Revenues from the withholding tax rate are an important source of income for the government of Senegal

·The GST on royalty income in India is determined based on the rate applicable to goods such as minerals This means that the same tax rate applicable to minerals—18%— is accepted as the royalty GST rate Additionally individuals who are liable to pay GST under the RCM for royalty should make sure to submit GST invoices in an organized manner

·Senegal The rate of corporate income tax is 30% Deloitte 2018 Mining royalties are levied between 2% and 5% Finan & Fall 2017; Norton Rose Fulbright 2017 South Africa Mining companies are taxed at a rate of 28% The royalty rate applied to each mineral is determined according to a formula with the range as follows

·Accessing high quality data on royalty rates RoyaltyRange provides the royalty rates data you require Our database comprises reliable high quality data on the latest comparable license agreements for IP and royalty rates You can access the data by subscribing to our database or by making a royalty one search request

·Accessing high quality data on royalty rates RoyaltyRange provides the royalty rates data you require Our database comprises reliable high quality data on the latest comparable license agreements for IP and royalty rates You can access the data by subscribing to our database or by making a royalty one search request

US$5 billion was invested in Senegal s mining sector from 2000 to 2013 and the Government wants Senegal to become one of Africa s top seven gold producers with an annual production of 17 tonnes of gold by 2020 The annual surface royalty for a small mine permit is FCFA 50 000 per hectare and for a mining permit is FCFA 250 000 per

·Cabinet approves royalty rates for mining of three critical and strategic minerals Lithium Niobium and Rare Earth Elements REEs Posted On 11 OCT 2023 3 23PM by PIB Delhi The Union Cabinet chaired by the Prime Minister Shri Narendra Modi approved amendment of Second Schedule of the Mines and Minerals Development and Regulation Act

·Types of royalties in WA Mineral royalty rates the subject of the Review are established by the Mining Act 1978 WA Mining Act and Mining Regulations 1981 WA Mining Regulations and various State Agreements They are either a specific rate per tonne of production or ad valorem a percentage of the resource s value

·Overview of business environment/doing business in Senegal as it pertains to taxation both individual and corporate Worldwide Tax Summaries The main industries of Senegal include food processing mining cement artificial fertiliser chemicals textiles refining imported petroleum and tourism WHT rates % Dividends/Interest

·Chapter 4 adopts a project economics perspective It compares the royalty types introduced in Chapter 3 on the basis of three hypothetical mine models each featuring economic and physical characteristics of relevance to the royalty calculations The models include an underground gold mine an open‐pit copper mine and an open‐pit bauxite mine

·This paper explores the impacts of a potential royalty mechanism by considering the effects of different royalty and tax rates on the economics of a hypothetical commercial lunar ice mining project

·Mining royalties contributed more than 41% to the Territory s total own‑source revenue in 2019‑20 and are the single largest own‑source revenue They are calculated at the rate of 20% of the net value of saleable mineral commodities sold or removed without sale from the production unit rather than on the gross production value or

·The state governments are authorized to grant mining leases and collect royalties from mining operations Royalties and Taxes Royalty Royalty is a payment made by the lessee to the lessor state government for the right to extract minerals It is considered a payment for the use of property rather than a tax

Graph 1 Mining royalty rates for gold in 2018 Source Authors calculations from the national legislation based on information available for a sample of 21 sub Saharan African countries Between 2016 and 2018 5 countries changed their mining

· Rates of royalty in respect of item No 10 relating to Coal including Lignite as revised vide notification number 349 E dated the 10th May 2012 read with corrigendum 525 E dated the 14 th June 2012 of the Government of India in the Ministry of Coal shall remain in force until revised through a separate notification by the Ministry of Coal

·Graph 1 Mining royalty rates for gold in 2018 Source Authors calculations from the national legislation based on information available for a sample of 21 sub Saharan African countries Between 2016 and 2018 5 countries changed their mining royalty rates Rates are mostly on the rise

·tax/royalty fiscal regime CIT is based on net profits with rates typically varying between 25% and 35% Royalty payments in the minerals sector are typically between 2% and 10% of gross sales and provide earlier and more stable/predictable revenues over the life of the mining operation Royalty

About Us Vox is a returns focused mining royalty company with a portfolio of over 60 royalties spanning seven jurisdictions The Company was established in 2014 and has since built unique intellectual property a technically focused transactional team and a global sourcing network which has allowed Vox to target the highest returns on royalty acquisitions in the mining royalty sector